Forex Trading is one of the most popular and significant markets worldwide, with a daily trading range increasing from $6.6 trillion to $7.6 Trillion. Due to its excellent Forex Trading profits, It is no wonder that a massive number of people are interested from time to time. Forexmarket is open 24 hours per day and five days per week, but it is only closed from Friday evening till Sunday evening.

According to Gitnux Forex Trading 2024 reports, over 80% of global Forex Trading involves trading seven main currencies: USD, EUR, JPY, GBP, AUD, CAD, and CHF. The average daily FX trading volume increased more than 39% from 2010 ($3.97 trillion) to 2024. Malaysia accounts for nearly 2% of the daily volume of global Forex Trading. Having a good Forex Trading strategy is super important for making money.

With the best Forex trading strategies, you know what to do in different situations, don’t get stressed, and don’t make silly mistakes. It is a perfect map to follow to reach your goal and make a steady profit. This article will discuss 17 top-notch Forex Trading methods for beginners to develop effective strategies. But let’s first define a Forex Trading Strategy.

Table of Contents

Forex Trading Strategy

What is the No 1 rule of trading? Rule 1 of trading is to choose a Forex Trading strategy /plan.

“ Forex Trading strategy is the process of analyzing the Forex market and making decisions on buying and selling currency pairs, using techniques and rules used by traders.” It can be simple or complex and vary from trader to trader.

Forex traders sometimes use technical or fundamental analysis to define entry rules, while fundamental analysis demands more discretion in Forex Trading strategies.

Behind every trader is a strategy to work on, achieve consistency, and measure their performance accurately. Forex Trading strategies are available across the Internet and are developed mainly by traders. Automated or manual tools are also used to create Forex Trading strategies.

The most significant FX trading strategy was achieving 7506 billion dollars (7.506 trillion). The United States contributed 88.46% of turnover in 2022, or 6639 billion.

Some most major Forex pairs included:

Most Traded ForexPairs

| Forex Pairs | Forex Pairs | Forex Pairs |

|---|---|---|

| EUR/USD | EUR/GBT | USD/CHF |

| USD/JPY | GBT/JPY | EUR/JPR |

| GBP/USD | GBP/AUD | EUR/JPR |

| AUD/USD | GBP/CAD | EUR/ JBP |

| USD/CAD | GBP/CHF | NZD/USD |

| USD/CNY | CAD/JPY | NZD/CHF |

How To Choose the Best Forex Strategies?

ForexTraders must choose the right Forex strategy that works best for them and eases their Trading process. USD is the most traded currency and accounts for 88% of the trading volume in the Forex market, including EUR/USD and USD/JPY. Forex traders spend a lot of time trading strategies with demo reading accounts for back-testing methods. This gives tests in a safe and free-risk environment.

Even Lucky often, if any Forex trader reaches a point of perfect result-driven Forex strategy and feels right, it is probably unlucky to remain with that exact mode of Forex strategy over an extended time. The financial markets constantly evolve, and traders should grow with them for success. Beginner ForexTraders should avoid using too many technical indicators and opt for simple, preferable strategies. Technical indicators cause information overload and conflicting signals.

Status consistently tweets its strategy as it progresses and uses the experience it gains from backtesting and demo trading methods. Some currencies provide extraordinary results. You can also select the best Forex Trading strategy based on currency value. Some of the most significant Forex Trading values are currencies, according to FOREX.IN.RS, are:

| Currency Rank | Currency | FX SYMBOL | FX MARKET TURNOVER % |

|---|---|---|---|

| 1 | U.S DOLLARS | USD | 88.5 |

| 2 | EURO | EUR | 30.5 |

| 3 | JAPANESE GEN | JPY | 16.7 |

| 4 | STERLING | GBP | 12.9 |

| 5 | RENMINBI | CNY | 7 |

| 6 | AUSTRALIAN DOLLAR | AUD | 6.4 |

| 7 | CANADIAN DOLLAR | CAD | 6.2 |

| 8 | SWISS FRANC | CHF | 5.2 |

| 9 | HONG KONG DOLLER | HKD | 2.6 |

| 10 | SINGAPORE DOLLAR | SGD | 2.6 |

17 Forex Trading Strategies

Choosing the best FX trading strategy from a wide range of Forex Trading strategies is beneficial. These strategies can save you money and precious time. They can also help you to trade successfully and grow in the trading market.

Here are 17 Common Forex Trading Strategies for beginners.

#1 Range Trading Strategy

Range trading is one of the best Forex Trading Strategies for finding entry and exit points in the market. A market is a steady trade between two nonlinear forms of support and resistance. Drawing trend lines between highs and lows is the best way to establish whether the market is range-bound or trending. There are continuously higher highs or lower losses than the slope up or down while looking at a trending market.

However, the trend line would appear flatter in a range bond market as the highs and lows are similar. It is used by most subscribers who subscribe to short-term trading styles like scalping and day trading. Range trading is the best way to take advantage of the market’s small and fast pricing in exchange rates.

#2 Price Action Trading

Focuses on the decision-price movements of an instrument rather than incorporating technical indicators like RSI, MSCD, and Bolinger bands. Price action trading offers a variety of strategies, from break-out reverses to simple and advanced patterns. Technical indicators are not part of a price exchange strategy, but they incorporate it and do not play a significant role.

Give your charge to remain clean and less from suffering information overlord rather than many indicators representing conflicting signals to confuse beginners. Price action trading is best for FX traders who want to profit from short-term movement. With this trading, you need to make decisions quickly and have a clean chart to focus on price action, making the process easier.

1.1772: It is the best support level, and traders wait for a breakdown to start EUR/USD trading. Overall, trading will be downward, and the currency pair fell more than 70 pips before support at 1.1700.

#3 Day Trading Strategy

Do you love short-term FX trading? If any Forex trader loves to trade for a short period but is uncomfortable with the fast nature of scalping, day trading is the best replacement among Forex Trading Strategies. Forex day trading involves one trade per day overnight.

Forex day trading requires time for research, monitoring the trade, and a thorough understanding of how the economy affects the pair you are trading. Any adverse economic news that hits that day will affect the Forextrader’s position.

#4 Forex Position Trading

Some Forex traders love position trading because it is less concerned with the short-term market location and more focused on long-term benefits. These traders hold a position for weeks, months, or even years without hassle. Forexposition Trading aims to appreciate the currency pair’s value over a long-term period.

#5 Trend Trading Strategy

Trend trading is a strategy for identifying market trends and allocating assets accordingly. It is based on technical, analytic tools like moving average trendlines and momentary indicators, including secular, primary, and secondary intermediate trends. Trend strategies have moving averages suitable for many marketers’ goal of capitalizing on market momentum.

Standard trading strategies are risky due to signals, lagging indicators, and reversal. Bag testing or demo trading can be beneficial in defining the strategy for trading real money. When a price moves, an uptrend shows, and declining prices represent a downtrend. Price action also uses supporting tools to identify trends. One example is the 50DMA and 200DMA. The 50-day average crossing near the 200-day moving average indicates the beginning of the uptrend and vice versa.

#6 Forex Scalping Strategy

The Forex scalping strategy is preferred by many Fx traders who prefer short-term trades held for a few minutes and those who want to capture multiple price movements for scalping.

In the short term, these trades have a few pips, but combined with high leveraging traders, they can still run the risk of losses.

The scalping strategy involves dedicating time to high-volume trading periods and making rapid trades. Liquid FX currencies are often preferred as they contain the tightest spreads, allowing traders to enter and exit positions quickly.

#7 Forex Swing Trading

Are you also a fan of the mid-term FX trading style? Some traders value this style, which allows positions to be held for many days. They aim to make a profit from price changes by identifying the swing highs or swing lows on a trend basis. This FX trading strategy requires less time to fix on the market than day trading. It leaves the risk of many disruptions overnight and gapping.

#8 Retracement Trading

Retracement trading includes temporary changes in the direction of various trading instruments. It should not be confused with a reversal in the trend, while retracement is just temporary, and it is the direction of the trend.

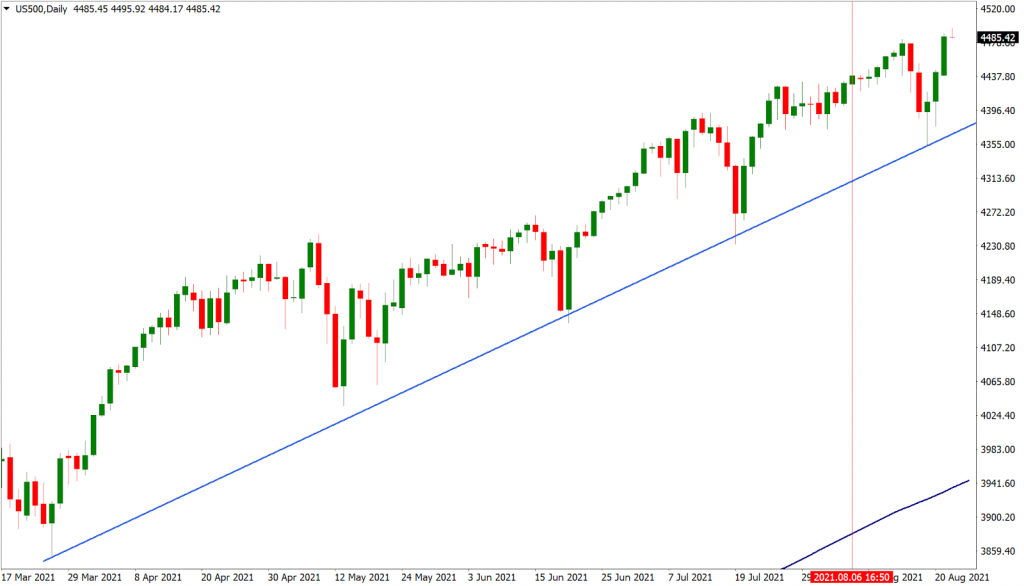

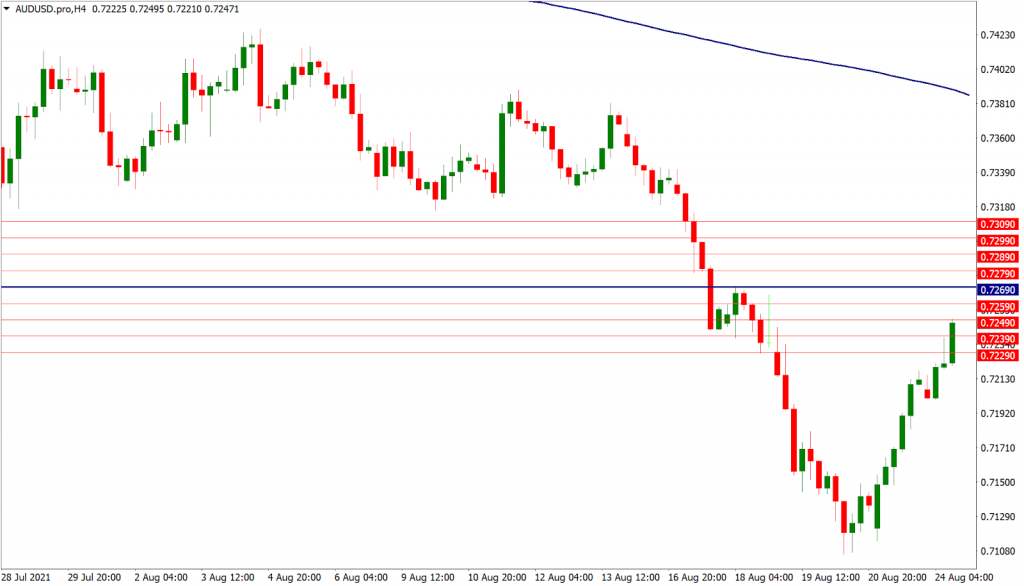

Forex retracement trading has several methods. For example, somebody used trendlines on the US500 chart. The index is clearly in an uptrend, and the rising trendline has been used as a buying opportunity. Fibonacci is also a widespread trade retrace platform, especially at 38.2%, 61.8%, and 78.6%.

#9 Grid Trading

Grid trading is one of the best trading approaches. It involves buy and sell orders at fixed intervals at price levels to take advantage of market volatility within a defined range.

This strategy is profitable in both ways. Marketers buy orders at intervals above the price and sell orders at regular intervals below their prices. The main benefit of the Gris strategy is that it requires forecasting market direction and easy automation.

Example of ForexGrid Trading

The trader observed a Bitcoin for $40,000.Instead of guessing where it will go next, use the grid strategy. They place buy orders at every $1000 rise. So they buy at $39000, $38,000, and so on, and sell at $41,000 and $42000.

Top Benefits Of ForexGrid Trading Include

- Profitability in a lot of market conditions.

- Automation.

- Structured approach.

- No need for a market.

- Multiple entry and exit levels.

To Implement the Grid Strategy, Follow These Steps

- Select currency pair and time frame for the Forex grid trading approach.

- Determine the price range or level at which you want to place a grid order and establish the take profit and stop loss levels for each other.

- Execute FX strategy grid orders.

- Keep an eye on the market.

- Adjust grid orders based on changes in the Forex Trading market.

#10 Carry Trade Strategy

Carry trade is also one of the best Forex Trading strategies for beginners. It involves lower-interest currency pairs to find the purchase of currency pairs with higher interest rates.

Carry trade strategy can be positive or negative based on trading pairs.

The Carry trade strategy profits from differentiating the interest rates or the interest rate differentials between two foreign currencies.

#11 Breakout Strategy

Many Forex investors use the breakout FX trading strategy to take a position within a trend’s early stages. This strategy can be the starting point for some significant prices and, when used properly, offers Limited downside risks. The first thing in trading breakout includes identifying current prices and patterns that can provide spot and existence levels for every possible entry and exit point.

You must know how to cut and re-access losses in the breakdown structures. Consider a support and resistance level for more valid stock prices with predetermined exits for successful trading approaches.

Breakout FX trading must include

- Identify the candidate.

- Wait for the breakout and set a reasonable objective.

- Allow stock for reset. Know trade patterns.

- Exit trades.

- Be patient.

- Exit at your target.

#12 News Trading

News strategy is one method by which traders profit from significant news event triggers. These could be anything from current back meetings and formal economic data releases to unexpected events. News trading can receive what some traders need because it is volatile during those times and finds a separate part of the affected treading instrument. It is a trade that could be executed in the worst place, then expect the Forex trader to a significantly worse prize, then act at the level in mind.

You can start new FX trading by determining which event you want to create and which currency you want. Then, a specific country player makes and uses currency like Japanese EUR/JPI, which could also be the right choice. News FX trading also works with or without blah, which means you will capture big moves regardless of direction.

5 More Effective Forex Trading Strategies

What are the five trading strategies? These 5 effective trading strategies include Bollinger bounce, support & resistance, pin bar,bollinger breakout, and momentum trading.

The 5 effective Forex Trading strategies details are as follows:

#13 Bollinger Bounce Strategy

Bollinger Bounce FX trading strategy has been a highly effective technical analysis indicator for decades. It creates a channel around any field movement on a chart, which acts as a boundary or potential support level if touched and causes reversals. This behavior is the Bollinger bounce FX trading strategy. In this case, wait for the Bollinger to close, then a few pips below the latest low before a minute. Target the upper-blowing band.

#14 Support And Resistance Strategy

Enjoy with support and resistance. It is a powerful strategy for FX trading. It sells itself at resistance by providing support with tools like private points to help; otherwise, their level will be insufficient. Enter trades on a daily, weekly, or monthly basis.

Like the profit target is at the opposition level,10-20 pips stop losses from recent highs and lows.

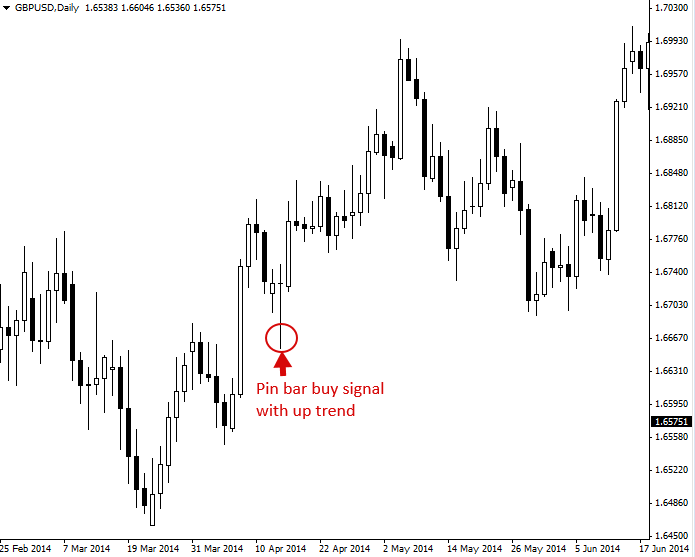

#15 Pinbar Strategy

Use a pin bar strategy for price reversals. Combine it with support and resistance for more accuracy. Set a profit target at the next support or resistance zone. Set a stop loss above or below the pin bar for risk management.

#16 Bolinger Breakout Strategy

Bolinger Breakout strategy is based on top-notch Forex Trading strategies. Red lines highlight the screen, while green signs the breakout. In the chapter, a sell trade is the breakout of lower Bollinger yields a decent profile.

Anyhow, if a breakout occurs in upper Bollinger, the signal executes a break strategy and puts a stop limit on up and down the candles. Metatrader 4, like DDFX or Ttiadne tren, also stands on the Bollinger breakout strategy and helps improve trading strategies.

#17 Momentum Trading

Momentum trading or momentum indicators lie on the idea that solid price movements in a direction are a good sign because the price trend continues to go in that direction.

However, weak resistance indicates that the trend has lost its resistance and could be headed by reversals. Both pricing & trend will be considered, and oscillators or candlestick-like tools are often used.

How to Develop A Forex Trading Strategy?

Whenever ForexTraders develop a trading system, they need to realize and ultimately know how much money they are willing to lose on each trade. Many people in Forex Trading don’t like discussing losing. Still, perfect Forex traders always have a proper command of potential losses in Forex Trading strategies.

For developing a winning strategy, you can follow these topnotch Forex Trading strategies essential steps:

1. Know What Kind Of Trader You Are?

Why is it essential to know your trader nature point? The best thing about knowing what kind of traders you are focused on is your time, energy, and attention to developing Forex Trading strategies that work according to your FX trading style.

Sometimes, the basic strategy is to make money for one type of trade style, which can benefit one but could be a better fit and a losing strategy for another kind.

To Answer This Query, You Must Ask Yourself The Following Questions

- Why trade you need?

- Your financial goals achievement.

- Basic Market knowledge.

- Education is needed before starting FX trading.

- Trading frequency.

- Your risk level.

- Effective Emotional Control.

- Trade timeframe preference.

- Checking trades frequency.

- Approach for Analytics Preference.

- Trading budget allocation.

2. Define Your Method Of Entering And Existing In The Market

What methods of entering and existing in the market are best for your trading style? Need to determine the best setup and include these.

- Hedging.

- Forex arbitrage strategy.

- Forex pullback strategy.

- Breakout.

- Forex trend strategy.

Once you know your tracking condition, you can use it to trade ranging markets, trending markets, volatile and nonvolatile markets, pullbacks, or breakouts. Instead of a single strategy, try to adopt several strategies.

3. Define Your Risk

As a forex trader, you must know how to manage your risk effectively when trading at various places. Learn multiple techniques or steps regarding this. It’s all about knowing money willingly to lose in each trading position.

Standard risk management rules are:

- Only use money to afford to lose.

- Adapt risk management.

- Use the right position.

- Always use stop-loss.

- Set the risk ratio to a minimum of 1:2.

- Risk maximum of 1% per trading per capita per position.

- Avoid over-leveraging.

4. Choose Which Trading Style Works Best For You?

Ask yourself the comfortable trading style that you know works best rather than others. There are a few different types and categories within which you will fit:

- Trading time frame preference: day traders, Scalpers, swing traders, position traders.

- Kind of trading analysis preference: technical trader, fundamental trader.

- Risk tolerance preference: risk-averse,risk-loving,risk-neutral.

Scalper Or Day Trader

- Trades are opened and closed within the same day.

- Scalping aims for a small profit in the second to minutes, trading targets more pips, and they last a few hours.

- Focus and cube reaction due to show term trading strategies.

Swing Trader

- The medium-term approach exploits Momentum changes within the primary Trend.

- The position held for a few days to weeks.

- Require patients and favors technique analysis.

Position Trader

- A long-term approach based on long-term price is changing position or holding for weeks, months, and even years.

- less concerned with short and price adaptations and pressure fundamental analysis.

Conclusion

Forex trading can benefit if it is done with the right strategy or perfect mindset. The main crux to Forex Trading’s success is finding a plan that suits your style and backtesting the demo account before live usage. Developing a perfect Forex Trading strategy involves personal preferences, risk tolerance, market competition, diligent research, backtesting, and continuous refinements.

Go on to the best Forex Trading strategies provided in this article, which you feel comfortable with and have more profit margins. Finally, these Forex Trading strategies can be used to tackle the Forex market and achieve trading goals.

FAQs

What is the 123 trading method?

The 123 chart patterns a three-way formation where everyone reaches a pivot point.

What is the easiest strategy in Forex?

Moving average(MA) is considered one of the easiest strategies in Forex. It includes the average security price over the period to make it easier to spot trends.

What is the 531 strategy in Forex?

The 531 strategy is helpful for new traders due to the 24/7 nature of the market. It stands for five currency pairs of learning and trading.

What is the best strategy for Forex Trading?

The best strategy choice depends on individual preference, market conditions, & risk tolerance. However, popular strategies include price action, day trading, breakout trading, and scalping.

Is there any 100% winning strategy in forex?

The 123 chart patterns a three-way formation where everyone reaches a pivot point.

What is the 123 trading method?

A plan can only guarantee a 100% winning situation if the Forex Market is risky and complicated.

Leave a Reply